It is related to WeChat and Alipay payment! It will take effect on May 1.

Published in 2023

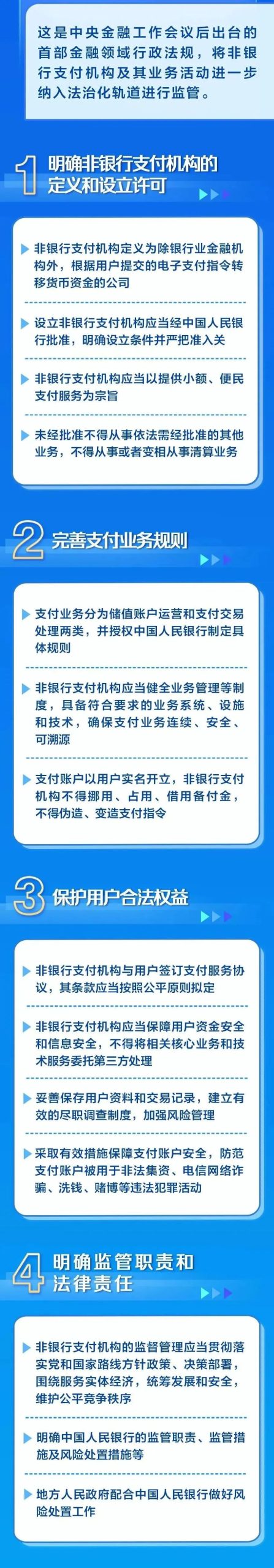

Regulations on the Supervision and Administration of Non-bank Payment Institutions

(hereinafter referred to as the "Regulations")

Non-bank payment institutions and their business activities

Further into the rule of law track for supervision.

It will take effect on May 1, 2024.

recent days

The People’s Bank of China issued

Detailed rules for the implementation of this administrative regulation

(Draft for Comment)

How will this administrative regulation be implemented?

What impact will it have after implementation?

Let’s listen to experts’ interpretation.

Set a reasonable transition period for replacement

Achieve a smooth transition

Non-bank payment, in simple terms, refers to payment services provided by other institutions instead of banks. For example, we often useAlipay and WeChat paymentWait.

The "Implementation Rules" clarify the procedures and timetable for issuing new payment institution licenses according to the new regulations. The transition period of replacement is set from the implementation date of the Detailed Rules to the expiration date of the payment business license of each payment institution. At the same time, considering that the expiration date of some payment institutions’ licenses is close to the implementation date of the Implementation Rules, the transition period of these payment institutions is relaxed to 12 months.

Upon the expiration of the transition period, the People’s Bank of China will renew the payment business license according to the new regulations. The reporter learned that,If the payment institution meets the requirements, it may also choose to apply for renewal of the payment business license in advance.

Dong Ximiao, chief researcher of Zhaolian, said that the transition period gave the payment institution enough time to prepare. At the same time, it turns out that the payment licenses of these payment institutions are valid for five years, and they have to apply for extension every five years. After the implementation of the new regulations, the payment licenses obtained by payment institutions have no time limit.

The implementation rules also clarify that some payment institutions should be appropriately decentralized to change the approval authority and reduce the approval level.

Wen Bin, chief economist of China Minsheng Bank, said: "For example, the change of company name or registered capital only needs to be accepted, examined and decided by the branches of the People’s Bank of China. This will improve the efficiency of examination and approval of administrative licenses and help to establish and improve an efficient and fast mechanism for handling changes. "

The data shows that up to now, there are 183 non-bank payment institutions in China. The annual transaction volume of non-bank payment institutions exceeds 1 trillion, and the amount is nearly 400 trillion yuan.

Do not change the payment institution.

Scope of original business license

What are the new rules for non-bank payment institutions in the implementation rules? Experts said that the implementation rules adhere to the principle of stability, pay attention to regulatory consistency, and ensure a smooth transition of the payment market.

Experts said,Previously, payment services were divided into three categories: online payment, bank card receipt and prepaid card business.With the technological innovation and business development, some emerging methods such as bar code payment and face-brushing payment have emerged. Regulations on the Supervision and Administration of Non-bank Payment InstitutionsThe payment business is re-divided into two categories: stored value account operation and payment transaction processing.The key to distinguish between these two types of business is whether the payer can receive the prepaid funds. The implementation rules announced this time put forward specific classification methods, which experts said would better meet the needs of market development and supervision.

Wen Bin said that the implementation rules fully consider the licensing framework under the current classification method and will not change the original business license scope of the payment institution, which means that the original business of the payment institution still exists, and it is not expected to have an impact on the business continuity and user experience of the payment institution.

In addition, the Implementation Rules also clearly require that non-bank payment institutions should make continuous publicity at least 30 days in advance if they want to adjust the charging items or charging standards, and the payment transaction records should be kept for at least 5 years.

Source: Xinhua News Agency CCTV News