It’s about Wanda! A well-known supermarket announced: Exit!

China Fund News reporter, Nan Shen

On the evening of December 13, Yonghui Supermarket announced that it plans to sell 1.43% of Dalian Wanda Commercial Management held by the company to Dalian Yujin Trading Co., Ltd. at a transfer price of 4.53 billion yuan. The transaction price is 612 million yuan higher than the carrying value premium. Considering that Yonghui Supermarket has held shares for up to five years, the return on this investment is obviously not high.

Just one day earlier, on December 12, Wanda Group announced that with the support of investors such as Pacific Alliance Investment Group (PAG), Zhuhai Wanda Commercial Management (the listed entity of Dalian Wanda Commercial Management) eliminated the gambling agreement, but at the same time Wanda founder Wang Jianlin also lost his absolute controlling stake in Zhuhai Wanda Commercial Management.

On December 13, some media reported that some existing investors chose to withdraw their investment in Wanda, but the vast majority of investors retained their investment, while new investors entered.

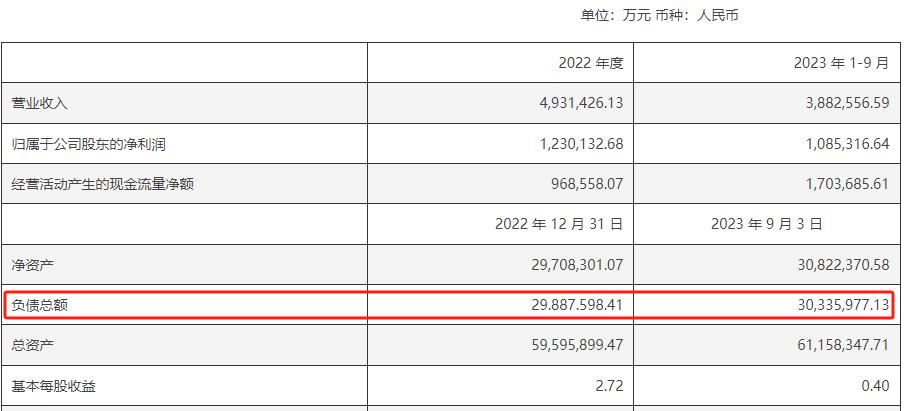

The announcement from Yonghui Supermarket also "spoiled" the financial data of Dalian Wanda Commercial Management. As of the end of the third quarter of 2023, Dalian Wanda Commercial Management had total assets of 611.60 billion yuan, net assets of 308.20 billion yuan, and liabilities of 303.40 billion yuan.

Yonghui Supermarket withdraws from Wanda Commercial Management

The receiver has more cooperation with Wanda

Yonghui Supermarket’s announcement shows that Dalian Yujin Trading Co., Ltd. (hereinafter referred to as the "Purchaser") intends to purchase 389 million shares of Dalian Wanda Commercial Management Group Joint Stock Company (hereinafter referred to as "Dalian Wanda Commercial Management") held by Yonghui Supermarket in cash, accounting for 1.43% of the total share capital of Dalian Wanda Commercial Management. The transfer price is 4.53 billion yuan.

Yonghui said that the purpose of this asset transaction is to revitalize the company’s assets and conform to the company’s strategy of reducing investment scale. As of the announcement date, the carrying value of the equity investment was 3.918 billion yuan. The company said that the price of this equity transaction is 612 million yuan higher than the equity carrying value. After the completion of the first phase of the equity transaction, it will affect the company’s pre-tax profit of 2859.58 million yuan in 2023.

The reporter noticed that the purchaser of this asset, Dalian Yujin Trading Co., Ltd. (referred to as "Dalian Yujin"), was only registered on November 30, 2023, less than two weeks ago, or specifically for this transaction. Tianyancha shows that behind Dalian Yujin is actually Dalian Yifang Group, and the ultimate actual controller is Sun Xishuang, the founder of Yifang Group.

Founded by Sun Shuangxi in 2001, Yifang Group focuses on investing in finance, cultural tourism, education, health and other fields, and has more cooperation with Wang Jianlin’s Wanda Group. Yifang Group is a major shareholder of Wanda Commercial Real Estate, Wanda Film, Centennial Life Insurance and other enterprises, and jointly invests in Wanda Xishuangbanna International Tourism Resort and Wanda Changbai Mountain International Tourism Resort with Wanda Group.

It is worth noting that five years ago in December 2018, Yonghui Supermarket purchased this part of Dalian Wanda Commercial Management from Sun Xishuang. At that time, the company signed a share transfer agreement with Dalian Yifang Group and Sun Xishuang to transfer 67.91 million shares of Dalian Wanda Commercial Management held by Dalian Yifang Group. The transfer price per share was 52 yuan, and the transfer agreement price was 3.531 billion yuan.

Now that five years have passed, Yonghui Supermarket is equivalent to selling the equity back to Dalian Yifang Group. Considering that the shareholding period is not short, the premium rate of only slightly more than 15% is obviously not high, and the annualized return is less than 3%. From the perspective of payment method, it is also relatively "harsh". Yifang Group pays in eight installments, and the last installment has gone to the end of September 2025.

Wanda Commercial Management’s latest financial data exposed

Assets over 600 billion liabilities over 300 billion

According to the announcement of Yonghui Supermarket, the transaction pricing is based on the financial statements of Dalian Wanda Commercial Management as of September 30, 2023 (unaudited), Dalian Wanda Commercial Management’s net assets under the parent are 304.268 billion yuan, and the corresponding net assets of 389 million shares held by the company are 4.354 billion yuan. "On this basis, combined with the current market conditions and competitive situation and other factors, the transaction price is determined to be 4.53 billion yuan through negotiation between the two parties."

The announcement also disclosed the latest financial data from Dalian Wanda Commercial Management.

As of September 30, 2023, Dalian Wanda Commercial Management’s net assets were 308.20 billion yuan, total liabilities were 303.40 billion yuan, and total assets were 611.60 billion yuan; in the first three quarters of 2023, Dalian Wanda Commercial Management achieved operating income of 38.80 billion yuan, net profit 10.80 billion yuan, and net cash flow from operating activities 17 billion yuan.

It is worth noting that on December 12, Wang Jianlin’s Wanda Group and Wanda Commercial Management just passed through a disaster.

On the same day, Wanda Group’s official website announced that PAG and Dalian Wanda Commercial Management Group jointly announced the signing of a new investment agreement. PAG will cooperate with other investors to reinvest in Zhuhai Wanda Commercial Management after its investment redemption period expires in 2021.

According to the new agreement, Dalian Wanda Commercial Management holds 40% of the shares, making it the single largest shareholder. Several existing and new investors such as Pacific Alliance participate in the investment, with a total shareholding of 60%. Previously, Dalian Wanda Commercial Management’s shareholding ratio to Zhuhai Wanda Commercial Management exceeded 70%. This also means that although the gambling crisis that is about to be triggered by the end of this year is lifted, Wang Jianlin has also lost his absolute controlling stake in Zhuhai Wanda Commercial Management.

According to the information disclosed in the previous prospectus, the institutional investors of Zhuhai Wanda Commercial Management include 22 companies including Pacific Alliance Investment Group, Zheng Yutong Family, Country Garden, CITIC Capital, Ant, Tencent, etc. The investment amount of these investors in Zhuhai Wanda Commercial Management in August 2021 is about 38 billion yuan, of which the investment amount of Pacific Alliance is about 2.80 billion US dollars (about 18 billion yuan).

However, Wanda has signed a gambling agreement with these investors. If Zhuhai Wanda Commercial Management fails to complete the listing work by the end of 2023, Zhuhai Wanda Commercial Management is obliged to buy back shares to the above investors. But so far, Zhuhai Wanda Commercial Management’s IPO in Hong Kong has made little progress, and it is impossible to list before the end of this year, which means that the repurchase agreement is imminent, making Wanda’s already stretched cash flow worse.

Now, with the signing of the new agreement, the crisis has been temporarily lifted. According to the China Securities News, citing people close to Wanda, the signing of the new agreement, some existing investors have chosen to withdraw their investment, but the vast majority of investors have retained their investment in Wanda. "More importantly, new investors have entered, including some foreign investors."

Editor: Captain

Review: Wood Fish

copyright notice

"China Foundation News" has the copyright to the original content published on this platform and is prohibited from reprinting without authorization, otherwise it will be investigated for legal responsibility.

Authorized reprint Cooperation contact: Mr. Yu (Tel: 0755-82468670)

Original title: "It’s About Wanda! Famous Supermarket Announces: Withdrawal!"

Read the original text