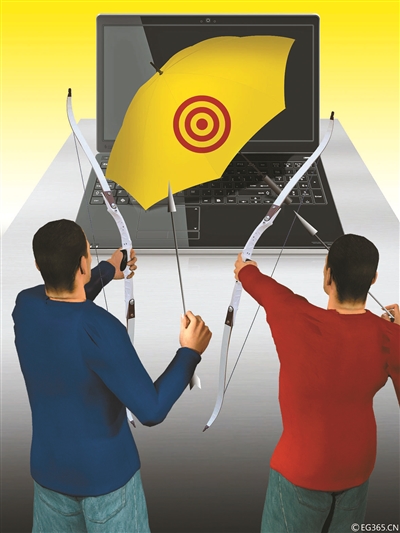

Beware of Internet insurance advertisements such as "0 yuan in the first month"

Yesterday, official website, China Banking and Insurance Regulatory Commission issued a risk warning on preventing insurance induced sales, reminding consumers to clearly understand that "free" is inducement, which is likely to hide traps and risks.

The relevant person in charge of China Banking and Insurance Regulatory Commission Consumer Protection Bureau said that from the insurance products themselves, some publicity such as "0 yuan in the first month" and "free protection" did not fully show the overall situation of premium payment, but actually spread the premium to the later period, and consumers did not really enjoy the premium concessions.

From the perspective of regulatory requirements, the terms and rates of insurance types should be reported to the regulatory authorities for filing or approval. In the sales promotion of "0 yuan in the first month", there is a problem that the approved or filed insurance clauses and insurance rates are not used in accordance with the regulations.

From the perspective of marketing methods, marketing unilaterally emphasizes "0 yuan in the first month", but fails to give full hints on the overall situation of premium payment, insurance liability and other important contents, which easily makes consumers ignore the important information of products. In addition, some advertising interfaces are not standardized, deliberately inducing consumers to check the options such as "purchase", "collection" and "automatic renewal", infringing on consumers’ right to know and their right to choose independently.

China Banking and Insurance Regulatory Commission Consumer Protection Bureau reminds consumers that when purchasing insurance, they should conclude corresponding insurance contracts with insurance companies according to their own risk protection needs and consumption capacity. According to the contract, the insured pays the premium, and the insurance company undertakes the obligation of economic compensation or payment in the event of an accident agreed in the contract. Do not be induced by "free" to prevent their rights and interests from being infringed. Photo courtesy/vision china

remind

What should I pay attention to when purchasing insurance products?

In order to protect the legitimate rights and interests of consumers and prevent risks such as induced sales, the Consumer Rights Protection Bureau of China Banking and Insurance Regulatory Commission, China reminds consumers to pay attention to the following matters when purchasing insurance products, so as to clearly buy insurance and clearly enjoy the protection.

First of all, because of the need to buy insurance products, I am not confused by "free". When browsing the insurance marketing publicity page, pay attention to the subject who publishes marketing advertisements and insurance product underwriting institutions, see clearly the important information such as insurance product types, coverage contents and charging methods, and choose and buy according to your own risk protection needs and consumption ability, so as not to be induced to buy unnecessary products by "free" marketing publicity. If you don’t understand the content of the publicity interface, it is best not to fill in personal information or agree to authorize it at will to prevent the risk of personal information disclosure.

Secondly, know the contents of the insurance contract and understand the terms and conditions before signing the contract. If consumers really need insurance, they should read the insurance contract carefully, and do not click OK on the sales page that fails to clearly show the terms of the insurance contract and other important contents. Focus on understanding the insurance liability, exclusion liability, insurance period, insurance amount, premium payment, risk warning, customer notification, insurance notice, renewal conditions, insurance compensation or payment, hesitation period and surrender loss and other important matters that affect the insurance decision. Don’t blindly follow the trend of impulsive consumption, especially when signing an insurance online, don’t "hook it to the end" for convenience.

Third, fulfill the obligation of telling the truth. When concluding an insurance contract, if the insurer makes an inquiry about the subject matter insured or the insured, the applicant shall truthfully inform him. The insurer has the right to terminate the contract if the applicant fails to fulfill the obligation of telling the truth intentionally or due to gross negligence, which is enough to affect the insurer’s decision whether to agree to underwrite or increase the insurance premium rate. Consumers should feed back relevant information objectively and truthfully, so as to avoid affecting the effectiveness of insurance contracts due to failure to tell them truthfully. Consumers conceal the real situation of insurance, and if an insurance accident occurs, they may not get insurance compensation, which is prone to claims disputes. This group/reporter Lin Lishuang

be relevant

The pilot product of endowment financial management will be launched in "four places and four institutions" as soon as the end of the month.

On October 21st, China Banking and Insurance Regulatory Commission’s Chief Prosecutor, Chief of Staff and Spokesman Wang Chaodi introduced the related situation of pension financial products at the press conference of the State Council Office. According to him, the products related to the pilot project of old-age financial management have entered the filing stage, and may meet with consumers at the end of this month or next month in the "four places and four institutions".

Wang Chaodi said that since the beginning of this year, China Banking and Insurance Regulatory Commission has taken the development of a series of financial products for the aged as an important part of improving the multi-level and multi-pillar endowment insurance system in our country.

China Banking and Insurance Regulatory Commission actively carried out the pilot project of financial management for the aged. According to the working idea of "jogging in small steps, overall gradual progress", on the basis of comprehensive consideration of urban scale, economic and social development level and residents’ demand for old-age care, and taking into account the needs of eastern, central and western regions, Wuhan, Chengdu, Shenzhen and Qingdao are selected as pilot cities for old-age financial management; At the same time, four wealth management companies, namely ICBC Wealth Management and CCB Wealth Management, as well as CMB Wealth Management and China Everbright Wealth Management, were selected to participate in the pilot project of pension wealth management products.

On the scale of the pilot project, according to the existing risk management and control capabilities and comprehensive considerations, it is determined that the fundraising scale of a single pilot project should not exceed 10 billion yuan in principle and the purchase amount of a single investor should not exceed 3 million yuan in principle.

The illegal inflow of business loans into real estate has been effectively curbed.

On October 21st, Liu Zhongrui, the head of the Statistical Information and Risk Monitoring Department of China Banking and Insurance Regulatory Commission, said at the press conference on data information and supervision of banking and insurance industry in the third quarter held by the State Council Office that the illegal inflow of business loans into the real estate sector has been effectively curbed. China Banking and Insurance Regulatory Commission has carried out nationwide special inspection of real estate for four years, and punished the found violations according to law.

Liu Zhongrui said that in recent years, China Banking and Insurance Regulatory Commission has firmly adhered to the positioning that "houses are used for living, not for speculation", and has firmly implemented the requirements of the long-term real estate mechanism to promote the stable and healthy development of the real estate market, closely centering on the goal of "stabilizing land prices, stabilizing housing prices and stabilizing expectations".

Liu Zhongrui said that in the next step, China Banking and Insurance Regulatory Commission will continue to implement the long-term real estate mechanism, guide banks and insurance institutions to accurately grasp and implement the prudent management system of real estate finance, maintain the continuity and stability of real estate financial supervision policies, and promote the stable and healthy development of the real estate market. In accordance with the principles of marketization and rule of law, cooperate with relevant departments and local governments to jointly safeguard the stable and healthy development of the real estate market and safeguard the legitimate rights and interests of housing consumers.

This group/reporter Cheng Jie, coordinator of this group/Yu Meiying